We launched The Super Model a month ago with a simple, silly mantra: “Polls stink. Forecasters stink. Markets are decent. This might be slightly better.”

The idea was to bring you the most accurate and actionable intel from the world of prediction markets, based on a few broad assumptions:

If your goal is to accurately handicap future uncertainty, market signals are generally superior to any individual forecaster or model (or even aggregates thereof) because any useful signal they throw off will be incorporated into markets.

While markets are the best mechanisms we have for discounting not only future cash flows, but future uncertainties, they’re not perfect and they’re not created equal. So by understanding their relative strengths and weaknesses (margin of inefficiency, liquidity, fee-based distortions, and market microstructure), you can likely derive an even better market signal by aggregating and weighting them by such factors.

A small number of traders are consistently better at forecasting than all the others. That’s presumably always been true, but until recently, it was only valuable to them. With the rise of blockchain prediction markets like

, we can scrutinize the historical performance (and current positioning) of every trader and seek to amplify their signal for even better, earlier insights.

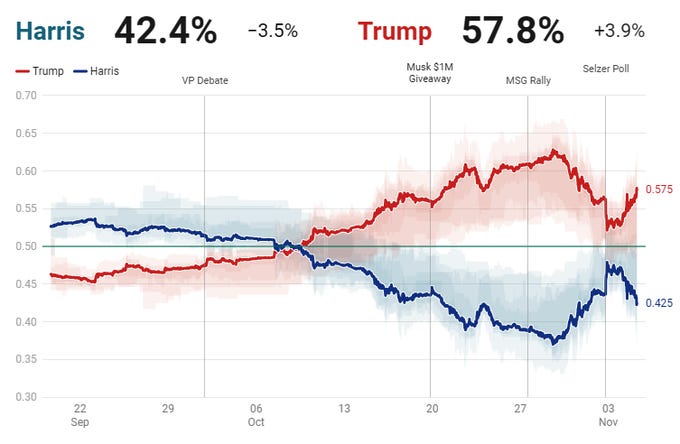

The first two are the basis of our market aggregates, which we’ve used to show you how the big 2024 electoral races were playing out in the mind of traders across the prediction market landscape.

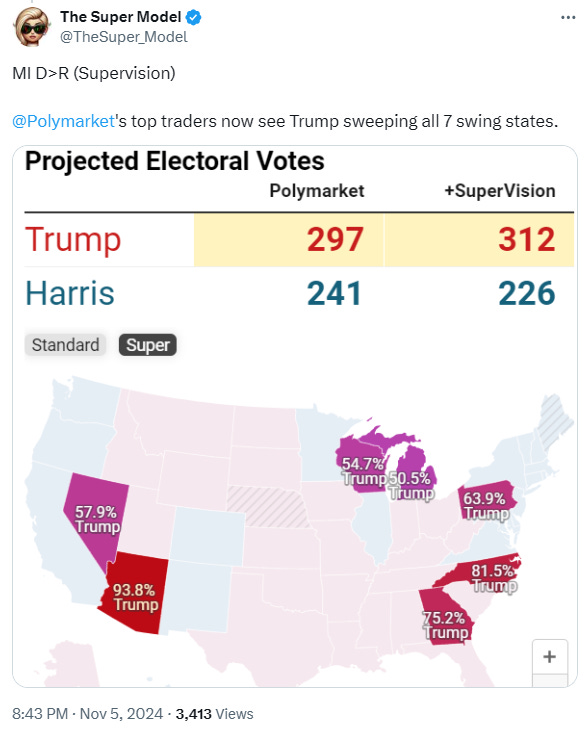

The third premise was the basis of SuperVision, we we debuted yesterday to track the most profitable Polymarket traders as they positioned themselves for election day and responded in real-time to early data.

The result was projecting the final EV count (and Trump’s battleground sweep) correctly at 8:43 pm, nearly 6 hours before the NYT Needle arrived at that projection and 9 hours before the AP called the race.

We had (might still be having) a few tech glitches and growing pains, but overall we’re very happy with our debut and hope you found it useful!

But this was all just a proof of concept. While media attention to such things is highly election-driven, preediction markets don’t go away after elections and neither will we.

In recent cycles, we’ve in fact seen huge new political and economic uncertainties unfold upon the inauguration of new administrations and new Congresses. Not only will this cycle follow suit, it looks to usher in potentially unprecedented uncertainty - from domestic economic and fiscal policy to existential geopolitical and technological risks.

So expect more market aggregates, more SuperVision dashboards around events big and small, and more prediction market analysis and commentary from our team.

Never before have prediction markets been more societally and economically valuable. And never before has the complex of such markets been so rich, diverse, and liquid.

This election cycle, the markets acquitted themselves well, at least vis a vis legacy forecasters and pollsters. But make no mistake - there will be biffs. Big biffs. Part of what we aim to do is sniff out those biffs so you can not only be prepared for unexpected outcomes, but potentially profit from occasional market mispricings.

As we said, markets not perfect. But they’re decent.

And we’ll continue to try to be slightly better.